Taken separately, they appear to be local stories. Together, they demonstrate how global retail growth is being rebuilt at present. What’s driving momentum today isn’t optimism or a return to old expansion playbooks. It’s selectivity.

Capital and brands are moving faster than before, but only where structural demand, platform-scale infrastructure, and execution capacity align. Formats and locations without a clear role are being deprioritized just as quickly.

This is not a pause. It’s a disciplined phase of growth, and it’s already reshaping where retail money concentrates.

Retail growth today is becoming selective, not defensive.

Across regions, what looks like expansion is actually prioritization. Decisions are sharper, timelines shorter, and tolerance for ambiguity much lower than in previous cycles. Retail is moving again, but it’s choosing its battles carefully.

In Saudi Arabia, that selectivity is visible at the platform level.

A major mall asset in Dammam has been repositioned and fully integrated into a global retail platform, moving away from a standalone regional model. This is not cosmetic rebranding. Global mall operators don’t attach their flagship brands lightly.

What’s happening here is a shift from local scale to platform scale. The asset becomes part of an international ecosystem for leasing standards, brand partnerships, marketing reach, and operational execution. It signals confidence in long-term demand and spending power, and it locks the market into a global operating logic early.

This is retail growth with commitment, not experimentation.

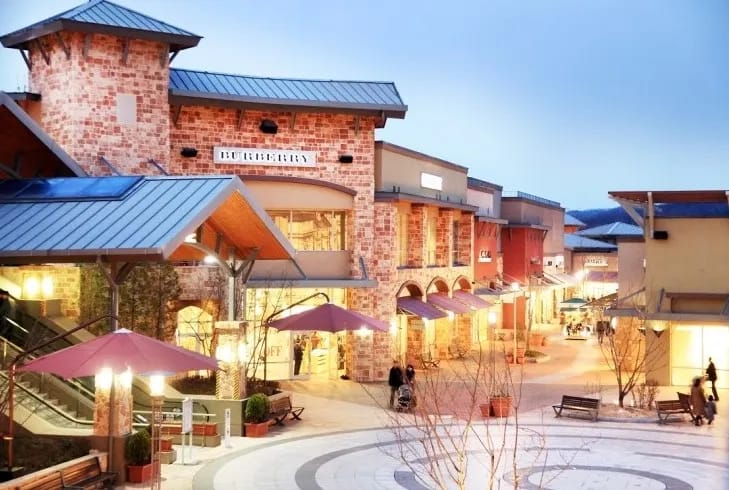

In South Korea, the same logic produces a very different outcome.

Urban outlet formats are increasingly struggling to justify their place in the retail stack. Too close to traditional malls to compete on experience, too physical to match online convenience, they sit in an uncomfortable middle ground.

What’s notable is not the struggle itself, but the response. The market is no longer trying to preserve these formats at all costs. Instead, we’re seeing consolidation, repositioning, and quiet exits. Capital is moving on quickly from assets that lack a clear, differentiated role.

This isn’t retail decline. It’s faster decision-making.

In Lagos, momentum is shifting in the opposite direction.

International brands are actively establishing physical retail presence, not as a branding experiment, but as a growth strategy. The timing matters. Brands are entering early, while infrastructure, consumer habits, and urban density are still forming.

These stores are not about prestige or visibility. They are about market capture. Fewer markets, deeper commitment, faster execution. It’s classic retail expansion logic applied with far more discipline than before.

On the surface, these stories look unrelated. In reality, they describe the same shift.

Retail growth is no longer spreading evenly. It’s concentrating where conditions allow speed, control, and scale to coexist. Markets with momentum are pulling capital and brands in faster. Formats without a clear function are losing attention just as quickly.

Money is flowing toward platforms rather than standalone assets, toward cities with demographic and spending momentum, and toward formats with a defined role in the broader retail ecosystem.

At the same time, it’s quietly leaving assets stuck between convenience and experience, and markets where growth narratives no longer translate into performance.

This is not a slowdown. It’s a reallocation.

This is exactly what Malls Money focuses on.

We track how retail growth is shifting across markets, not through isolated headlines, but through structural moves: platform decisions, format prioritization, and capital flows.

If you work with retail assets, brands, or an expansion strategy, these signals matter more than individual announcements.

We publish one to two focused issues per week. No noise. No recycled press releases.

P.S. In the next issue, we’ll break down why global retail platforms are moving faster than individual brands, and how this shift is already changing leasing power, market entry speed, and margins. If you care about where leverage is building in retail, that issue will matter.